vermont sales tax exemptions

W-4VT Employees Withholding Allowance Certificate. Printable Vermont Sales Tax Exemption Certificates Managing sales tax exemption certificates is a challenge for any.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

. 31 rows Sales Tax Exemptions in Vermont. Ad The Avalara report is available. The veterans town provides a 20000 exemption.

Vermont School District Codes. What is exempt from Vermont sales tax. Counties and cities can charge an additional local sales tax of up to 1 for a.

IN-111 Vermont Income Tax Return. Learn about new tax laws and industry changes. And discover some of the long-term effects recent events are having on tax compliance.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. As a business owner selling taxable goods or services you act as an agent of the. The law requires the seller to collect and remit sales tax on retail sales of tangible personal property and certain services.

In Vermont certain items may be exempt from the. PA-1 Special Power of Attorney. In general sales tax exemptions are statutory exceptions eliminating the need for the retailer to collect sales tax on a particular transaction or on all transactions with a customer.

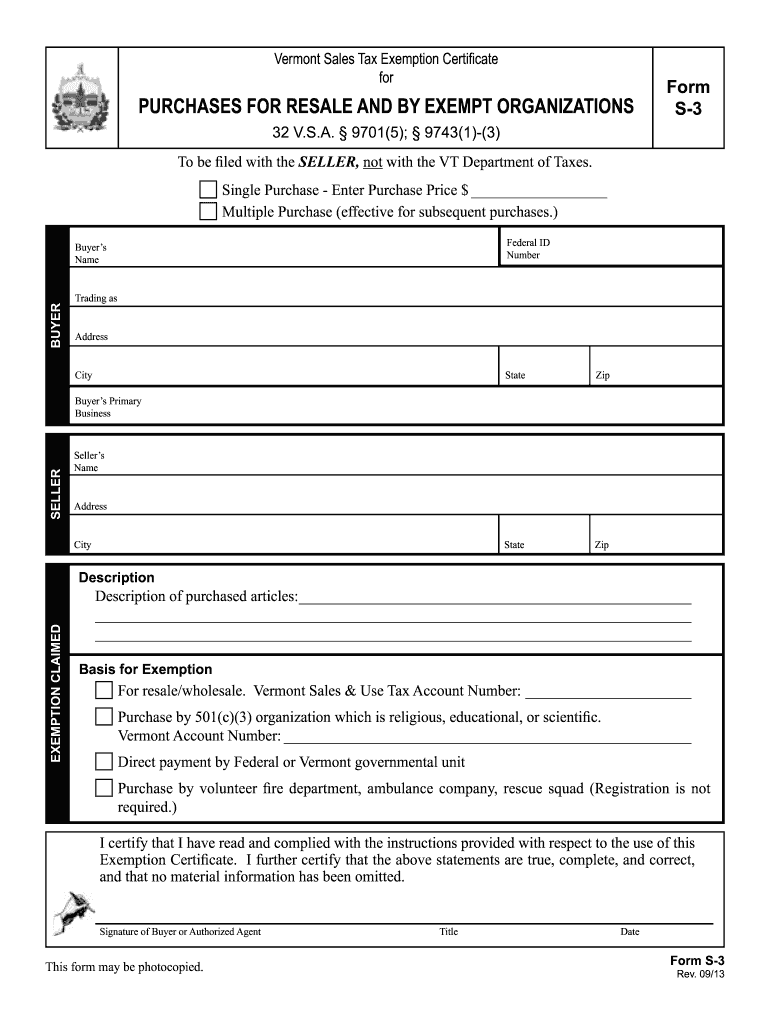

Ad Fill out a simple online application now and receive yours in under 5 days. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. This page describes the taxability of.

974114 15 16 24. Here is a sample list of exemptions. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. Ad The Avalara report is available. And discover some of the long-term effects recent events are having on tax compliance.

974113 with the exception of soft drinks. Also the state publishes rules that define and explain in more. A Vermont Certificate of Exemption is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods.

Soft drinks are subject to Vermont. Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5 PDF. What is Exempt From Sales Tax In Vermont.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. This page describes the taxability of. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Currently combined sales tax rates in Vermont range from 6 to 7 depending on the location of the sale. Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA. How to use sales tax exemption certificates in Vermont.

A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the. Local jurisdictions can impose. Exempt from sales tax on purchases of tangible personal property and meals not rooms.

Learn about new tax laws and industry changes. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from.

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

State By State Guide To Taxes On Retirees Retirement Tax States

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Vermont Income Tax Vt State Tax Calculator Community Tax

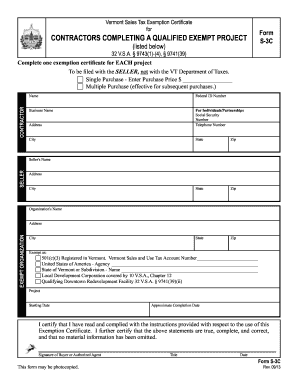

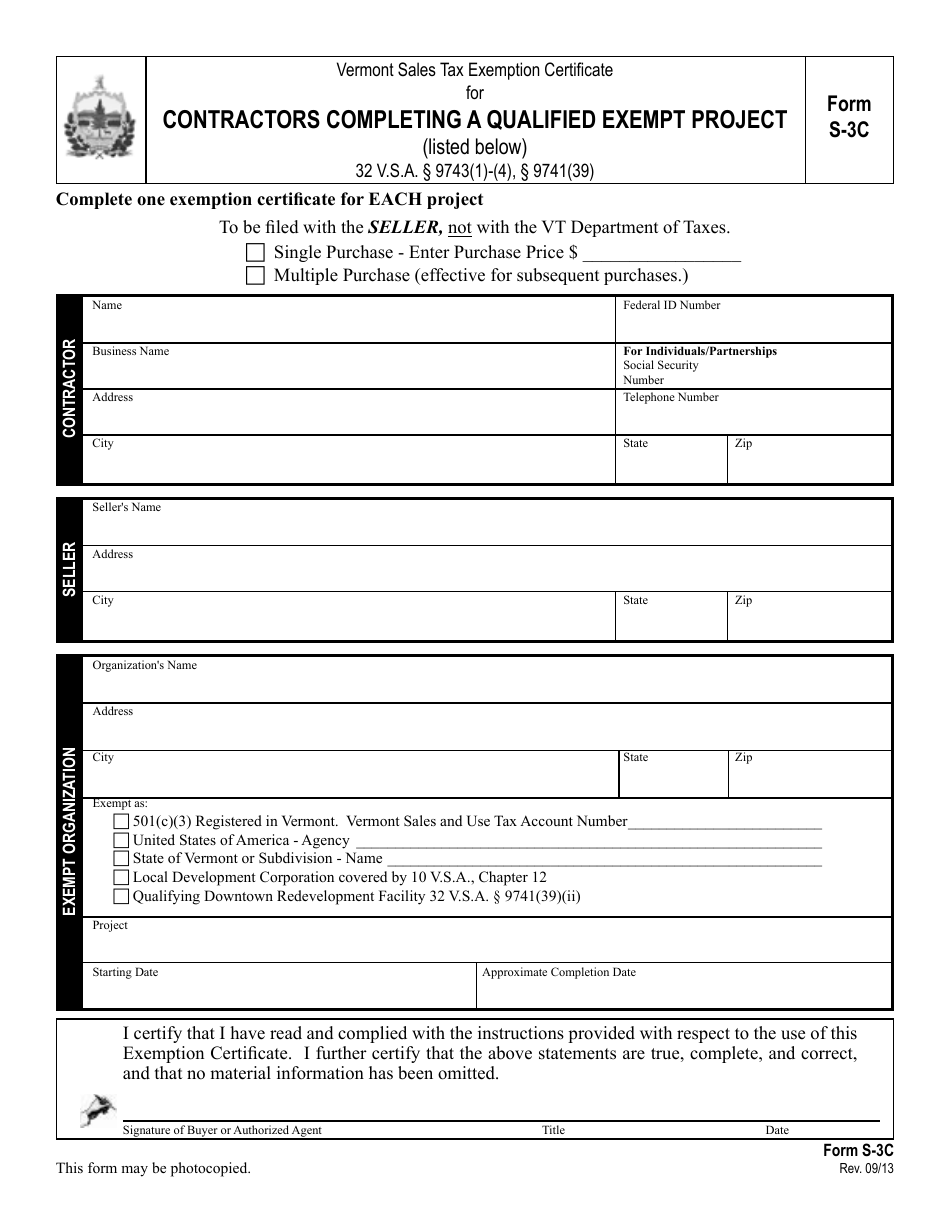

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

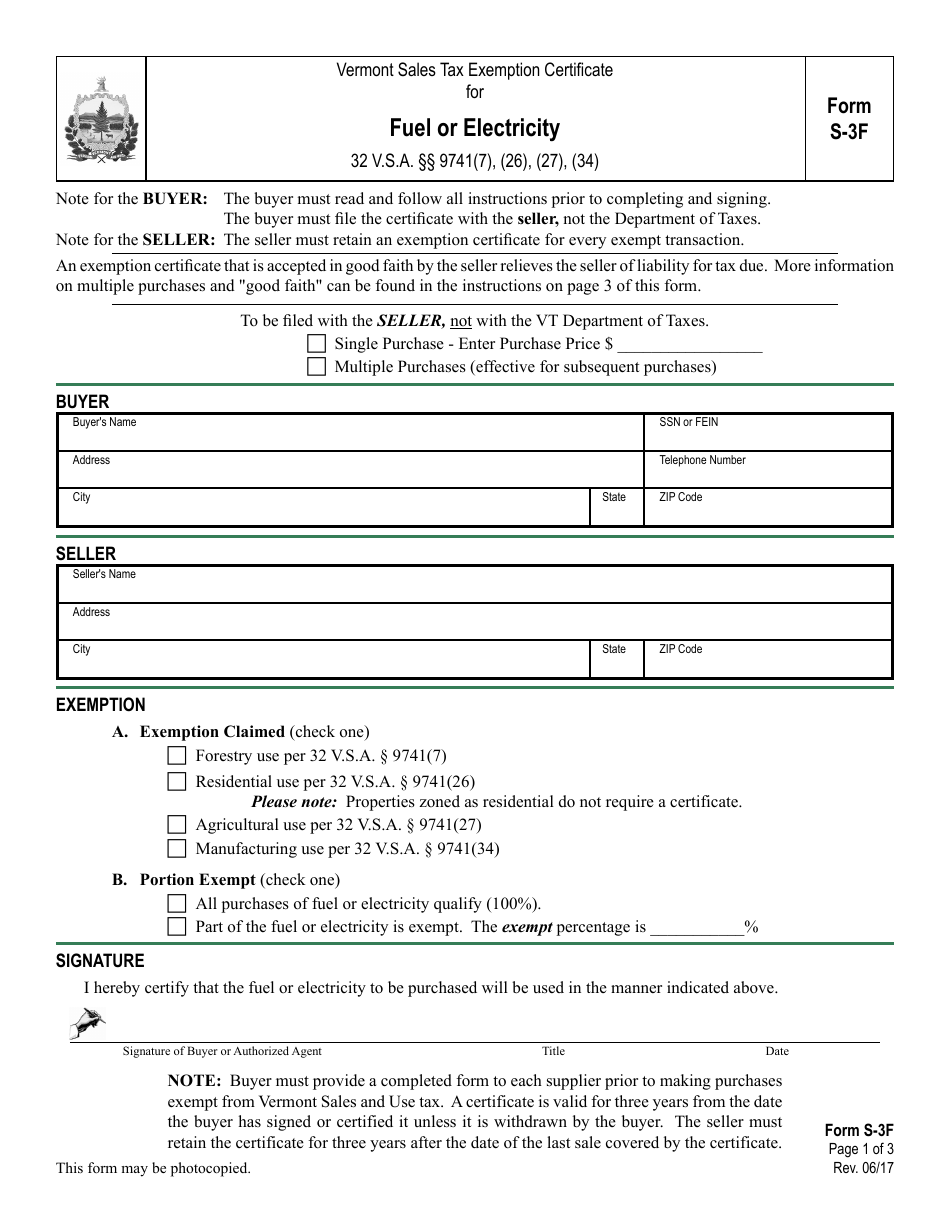

Vermont Utility Sales Tax Exemption Savings Smartsave

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Department Of Taxes Facebook

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

Vt Dot S 3 2013 2022 Fill Out Tax Template Online Us Legal Forms

Printable Vermont Sales Tax Exemption Certificates

Fillable Online Vermont Sales Tax Exemption Certificate Fillable Form Fax Email Print Pdffiller

Form S 3f Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Fuel Or Electricity Vermont Templateroller